Information is powerful and Profit is what you work for. Let us help you understand your company’s financial condition. We have years of experience in the day-to-day application of business bookkeeping and accounting and we understand the importance of accurate general ledger posting.

If you are a new or existing company we can set up an accounting system for your operation. If you believe your existing operation reflects inaccurate accounting information, we can provide audit and clean up of your existing books. Enjoy the benefit of having current and historical information represented in your profit and loss statements. Benefit, too, from reporting tools for strategic planning. Call us today.

Consider some of the Other Services we provide. If your business lacks in the knowledge base or skill to manage any or all of the services we offer, please give us a call. Whether you need sales tax reporting, or research and assistance in the acquisition of business insurance, we can help. Being audited? Let us assist you in the preparation prior to your meeting with the auditor. With over 30 years of practical experience, we have the expertise to assist you in all of your business bookkeeping/accounting and administrative requirements.

- Inventory Control

- Purchasing & Payable Services

- Sales, Receivables and Collection Systems

- Payroll Administration & Benefits Packages

- Bank and Credit Card Reconciliations

- Sales Tax & Financial Reporting

- Auditing, Training, & More…

Bookkeeping Perfected

Why is Art of Bookkeeping better?

Cheryl Holmes

Founder & CEOCheryl has over 30 years of accounting and bookkeeping experience in over 15 industries. In that time, she's helped her clients save millions of dollars.

Our Unique Approach

ACCOUNTS PAYABLE

Accounts Payable systems offer benefits such as knowing how much your operation owes its vendors, having the ability to pull historical and statistical reports, & having internal control. We implement or clean up and improve your existing system.

ACCOUNTS RECEIVABLE

Accounts Receivable systems offer the ability to track monies due by your client-base on extended credit terms. This is an asset to an operation and should be managed closely. We implement or clean up and improve your existing system.

JOB COSTING

Job Costing provides costs and income directly associated to a job. This is beneficial for construction or service-based operations that extend beyond a single install or service application in the execution of the sale. These usually have many moving parts. We help to implement this system.

INVENTORY CONTROL

Inventory control, together with a properly implemented payable and receivable system, adds another layer of control while providing ability to manage stock at proper levels. We implement or clean up and improve your existing system.

1099 REPORTING

1099 Reporting is required when utilizing non-employed resources that meet a minimum annual compensation amount. Implementation to properly track these resources simplifies year-end reporting and reduces cost. We implement these systems and provide 1099 reporting.

PURCHASING

Purchasing systems include utilizing vendor extended terms such as 30, 60, or 90 days to pay on invoices. These and offered discounts can be maximized to help with working capital and improve profit. We work with you to incorporate efficient, cost saving approaches to purchasing.

COLLECTIONS

Collections on accounts receivable is important to any business. An effective procedure to keep receivables under 90 days will better ensure the collection of all receipts. We work with you to develop control on aged receivables and to develop effective collection policies and procedures.

FINANCIAL STATEMENTS

Financial Statements present the financial condition and net income of your company. While the information on the Balance Sheet and Profit and Loss (or Income) Statements are most important to its owners, vested parties and managers, it is also needed at times for outside interests such as potential investors, lenders, or taxing authorities. Monthly, Quarterly and/or Annual reports are provided.

FINANCIAL MANAGEMENT

Financial Management should cohesively bring all of the accounting processes together. Each component of your business directly impacts an operation’s financial picture. Bank accounts, inventory, purchasing, & sales should all be carefully managed and reconciled regularly. Having good systems in place provide for internal control. We can help set up effective systems.

BANK & CREDIT CARD RECONCILIATIONS

Bank and Credit Card Reconciliations are an essential part of every business operation. Know at all times how much money your operation has and have confidence in the accuracy of your bank balance. This knowledge provides an important measure of internal control. We reconcile all accounts.

BUDGETS, PLANNING, & PRO FORMAS

Budgets, Planning, & Pro Formas are the lifeline of a company. Utilizing data gained from purchasing, overhead expenses, sales, seasons, markets, & competition help in the development of budgeting, planning, & proformas. We can help to develop these crucial tools for your business.

YEAR-END PACKAGING & TAX REPORTING

Year-End Packaging & Tax Reporting information is assembled, reviewed for accuracy, reconciled where needed, & presented to your CPA for year-end tax reporting. We work together with your CPA or can recommend a quality CPA to provide income tax reporting services.

AUDITING

Auditing is less painful when good systems are in place. Regardless of the condition of systems, when inside management, a bank, government, or insurance agency is requiring information, we are experienced in audit processes.

SALES TAX REPORTING

Sales Tax Reporting is a complex area for operations required to collect, report & remit to their state, county and cities. Proper accounting and collections help prevent loss of profit. We provide sales tax reporting.

PAYROLL

Payroll support provides the benefit of timely and accurate compensation to your staff, while ensuring that the reporting is in compliance with all state and federal regulations.

EMPLOYEE BENEFITS PACKAGES

Employee Benefits Packages attract quality personnel. Implementing employee manuals, locating and procuring quality and affordable health insurance can be timely and overwhelming. We can locate, procure, & implement benefit systems.

GENERAL LEDGER ACCOUNTING

General Ledger Accounting is the nuts and bolts to providing financial reporting. It is crucial to understand accounting when posting to the general ledger system in order to accurately present financial information. We have over 30 years of experience with bookkeeping and accounting.

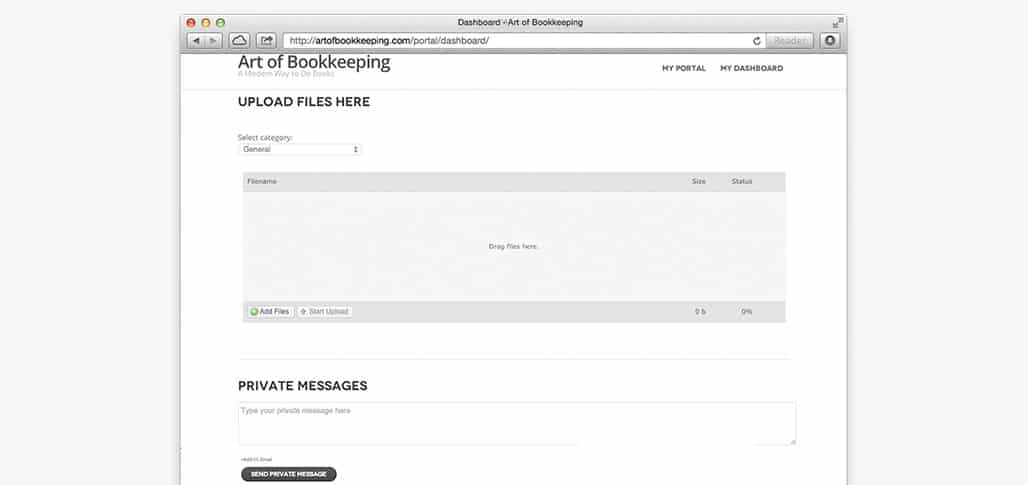

CLOUD ACCOUNTING SERVICES

Cloud Accounting Services are a means to free up office space and related overhead. Outsourcing your accounting saves your business time and money on payroll and taxes, employee benefits, insurance, & of course – office space. It frees up your checkbook to focus more on your business!